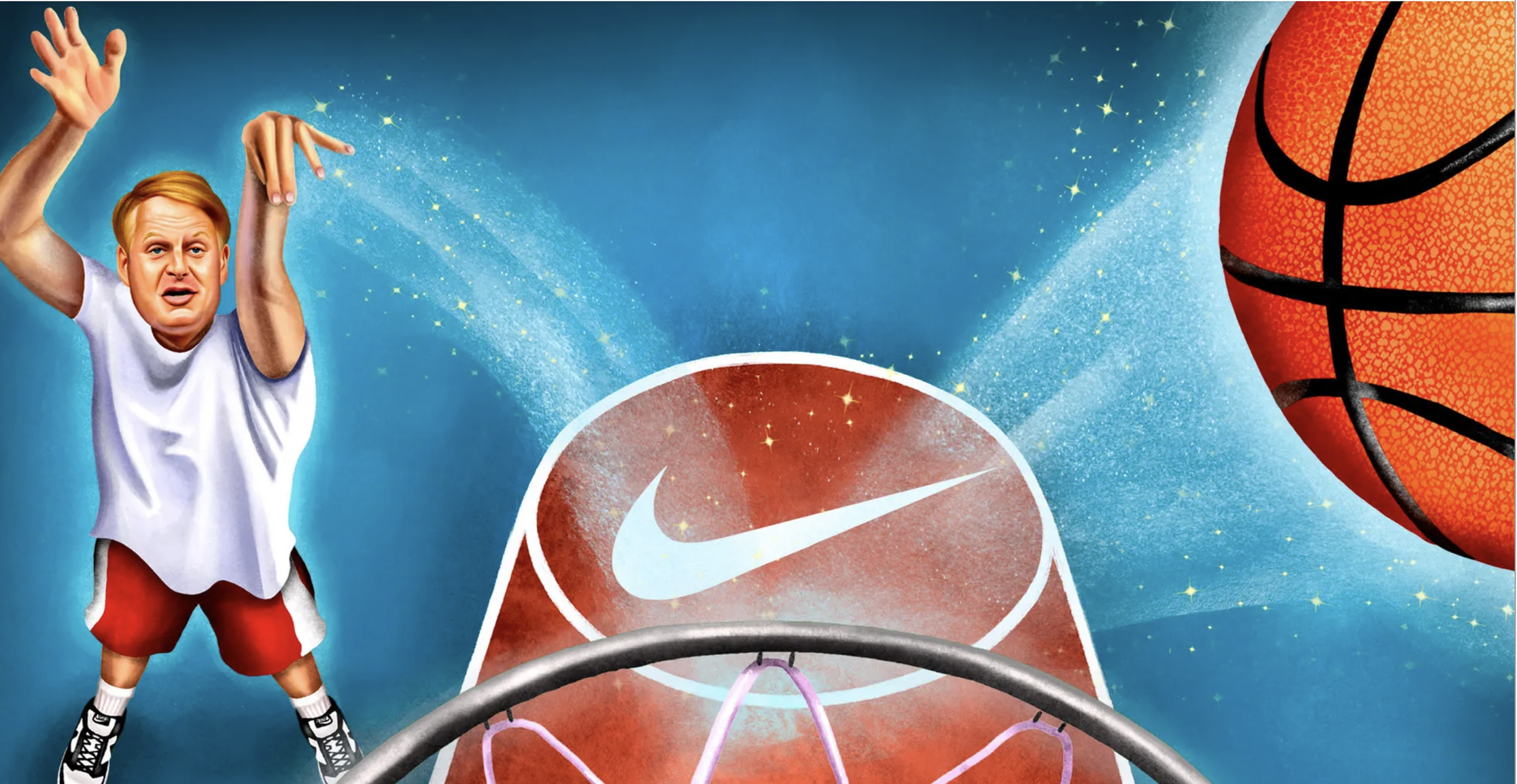

There was a lot of buzz recently about Nike and its CEO John Donahoe, who got dismissed from his precious position after all. The economical impact was dramatic as well:

Nike Q2 24 financial results. 25bn of market cap lost in a day (70 in 9 months). 130 million shares exchanged in the stock market (13 times the avg number of daily transactions). The lowest share price since 2018, – 32% since the beginning of 2024.

What went wrong and why did John Donahoe was not able to implement his DTC strategy? Coming from Ebay Donahoe was an e-commerce pioneer and wanted to transform also in a way that he probably knew from his form employer. In a memo to the staff he outlined the future strategy (only parts of it):

1) Nike will eliminate categories from the organization (brand, product development and sales)

2) Nike will become a DTC led company, ending the wholesale leadership.

3) Nike will change its marketing model, centralizing it and making it data driven and digitally led

How the new strategy played out…

This resulted in dramatic shifts in the communication department and the focus onto performance based digital campaign, rather then traditional brand advertising. In the perspective of the vision to be a digital first DTC brand, this maybe looks reasonable at first sight, but we have to put the gigantic sice of Nike into context. This is no sneaker startup that sells few 1.000 pieces a months via a Shopify store. Nike was a champion in sports apparel.

Also at first, during the pandemic, the strategy performed quite well. But as we all know, things went back to “normal” as soon it was over and people went out to stores to get their stuff. Already then Nike was not available any more in dozens of sports apparel store, cause as a result of the strategy relationship to retailer were cut (Belk, Big 5 Sporting Goods, Bob’s Stores, Boscov’s, City Blue, DSW, Dunham’s Sports, Fred Meyer, Macy’s, Olympia Sports, Shoe Show and V.I.M.). Foot Locker, where Nike products accounted for about 75% of sales, dropping to 70% in 2021, and below 60% in 2022 replaced the brand in their shelves with competitor brands.

Also on the product perspective Nike was struggling and just releasing variants of old classics like Air Force 1, Dunks etc. and true fans of the brand, that is deeply rooted in the athletic community, criticized the lack of innovation and focus on the professionalism of the products.

Breaking the wheels of distribution

John Donahoe went to war intended to break the wheel of traditional sport apparel retail and finally failed doing so.

This case anyhow tells a very important lesson in marketing: distribution is king. It might be thought as a brave move, to cut tights with the existing retail partners and shift to a DTC model, but the force of Nike was not powerful enough to transform the entire category. Was it foreseeable? Definitely. Elliott Hill, the successor of Donahoe as Nike’e new CEO, has now the task to fix the broken retail relations and bring the brand back to its former glory.

Leave a Reply